MEMBER’S GUIDE TO EXTENDED HEALTH CARE

What is Extended Health Care?

For millions of Canadians extended health care coverage is the critical bridge that closes the gap between neuromusculoskeletal health needs and having access to chiropractic services.

Currently 70% of all working Canadians have access to paramedical care through their extended health care benefits. According to the Canadian Life and Health Insurance Association (CLHIA), out of $28.7 billion spent on extended health benefits in 2019, $4.3 billion was spent on paramedical services alone. Without this coverage, many Canadians who rely on chiropractic care would not have access to the services and care they need.

Understanding this complex landscape is a critical part of your practice. It is part of your responsibility to keep on top of your record keeping, billing practices and meet the requirements of the patient billing cycles outlined by insurers.

Engaging in understanding how insurance plans work for the patient and for the insurance provider will assist you to protect your practice, help the patient navigate their benefit plan and avoid the pitfalls which may result in audits and investigations. The CCA has developed this resource centre to make it easier for you to remain informed about supplementanry health care benefits.

In short, you need to keep up to date on any changes. Not knowing how this all works is never an excuse when faced with an audit so, it may be time to crack the spine on the guide provided by your patient’s third-party healthcare plan.

But never fear, there are resources available to help you keep well informed!

We Can Help

To help you get started, we’ve outlined below the basics contained in most types of insurance plans and how to avoid some common errors and oversights. When in doubt about any of the details, you’ll need to double check with the insurance provider directly, as ultimately, they have the final say.

The CCA will keep this information updated. Watch for notifications in your monthly newsletter, Spinal Matters, on any changes or updates. We’ll direct you back here to learn more.

Let’s Get Started With The Basics

The insurance contract is between the plan sponsor, typically an employer, and the insurer. The choice of plan design and available coverage is determined by the plan sponsor and is based on the benefits that the employer wishes to provide, as well as the price they are willing to pay. Keep in mind insurance plans and chiropractic coverage will vary.

If patients have questions about their insurance plans, encourage them to ask their plan sponsor (employer, union) for a booklet or summary of benefits and to bring it in if they need assistance to determine their coverage.

They can also find out from their employer or plan sponsor whether a physician’s referral is necessary to access paramedical services or supplies. Most benefit plans no longer require a physician referral but checking ahead of time will avoid delays in reimbursement for the patient.

Pre-approval helps to ensure that the plan member understands whether the item is covered and if they must pay any out-of-pocket amount, before incurring expenses (for example, orthotics).

Plan members are usually provided with an ID card that will have a plan/group number, their name, and a member ID. The card may contain eligibility information for dependents. This information will be necessary for billing if the chiropractor is engaged in direct billing on behalf of patients.

Types of Insurance

Click here to understand the different types of benefit plans and the various ways your patients can be insured.

There are many ways your patients can be insured.

- Traditional Benefit Plans – provide coverage for prescription drugs, dental care and supplementary healthcare (further divided into benefits by provider type, such as chiropractic).

- Flexible Benefit Plans – offers plan members some choice in their coverage and the ability to change coverage levels or deductibles for certain benefits.

- Health Spending Account (HSA) – a sum of money that can be spent by the plan member on healthcare related products and services. The HSAs provides reimbursement for many healthcare providers and devices as outlined in the description provided to the patient. HSAs can reimburse for all practitioners recognized by Revenue Canada.

- Benefit Plan Limitations – the maximum dollar amount that will be paid out each year for certain benefits.

For more detailed information, please review page six (6) of the Supplementary Health Insurance Explained For Healthcare Providers guide, by The Canadian Life and Health Insurance Association (CLHIA). Additionally, patients can refer to their insurance booklet or contact their insurance provider directly for further information regarding their plan benefits.

Important resources

More detailed information can be found in the Canadian Life and Health Insurance Assocation (CLHIA) documents below.

Insurance Webinars

Health Insurance, Your Patients and Your Practice – What you need to know

Delivered by the Canadian Life and Health Insurance Association, this presentation is intended to help you better understand insurance in order to assist your patients. Learn how benefit plans are developed, who are the decision-makers when deciding how much the benefit should be? Confusing terminology and processes will be explained. An overview of billing expectations will be provided. Come with your insurance questions!

Benefit Fraud – An Introduction to Fraud, Trends and Industry Initiatives

Join us for the first of two webinars discussing benefit fraud. Learn the meaning of fraud and abuse, the impact it has on plan sustainability, how to protect your practice from fraud, trends within the insurance industry and how the industry is educating Canadians.

Benefits Fraud – Audits, Analytics and Incentives: What you need to know

In February we met to discuss an introduction to insurance fraud looking at the basics, trends and industry initiatives. In this second session, you’ll hear from a panel of insurers discuss in more detail the industry’s approach to audits, analytics and incentives.

Discover eClaims, TELUS Health’s free direct billing service, and how it can simplify the claims process for your patients. Join us for a live demonstration of eClaims, and an opportunity to learn more about direct billing and its benefits.

Pointers to Protect Your Practice

To make sure you and your practice are protected, review the checklist below.

Your patients often rely on supplementary healthcare coverage provided to them through employment benefits, or by purchasing individual coverage to access the services of healthcare providers. In order to protect your practice while supporting patients, here are some helpful pointers. Please keep in mind, these considerations are not professional practice advice, standards, or guidance, but simply some suggestions. For more information, visit ‘Working in the Private Sector, Insured Health and Dental Benefits: Important Considerations for you Practice.’

Checklist

- Protect Your Identity

Do not share your professional information (e.g. license number) with anyone you don’t have an agreement with on how and when it will be used. - Good Practice Practices

Ensure the clinic is in good standing with insurers and that they have good processes in place on benefits administration. - Submitting Claims

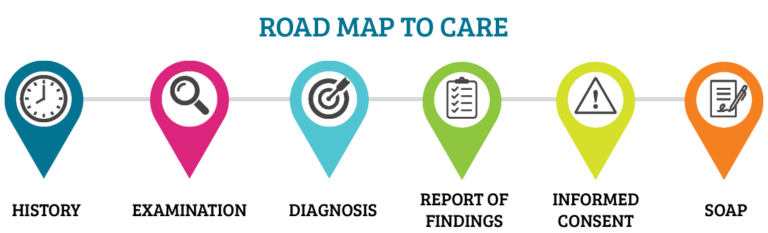

Ensure your services fall within your scope of practice and be aware of what is being billed under your name. For more information, review “Issuing Receipts”. - Roadmap to Care

The Roadmap to Care is used to provide competent patient care through comprehensive clinical notes and record keeping. While this roadmap impacts patient care, it is also a necessity when it comes to insurance billing. Once a receipt is submitted, it is possible for the insurer to request clinical notes as proof a service was provided. Your notes must be complete and justify a treatment. This means there is a history, physical examination, a diagnosis, informed consent and a treatment plan that has been documented.

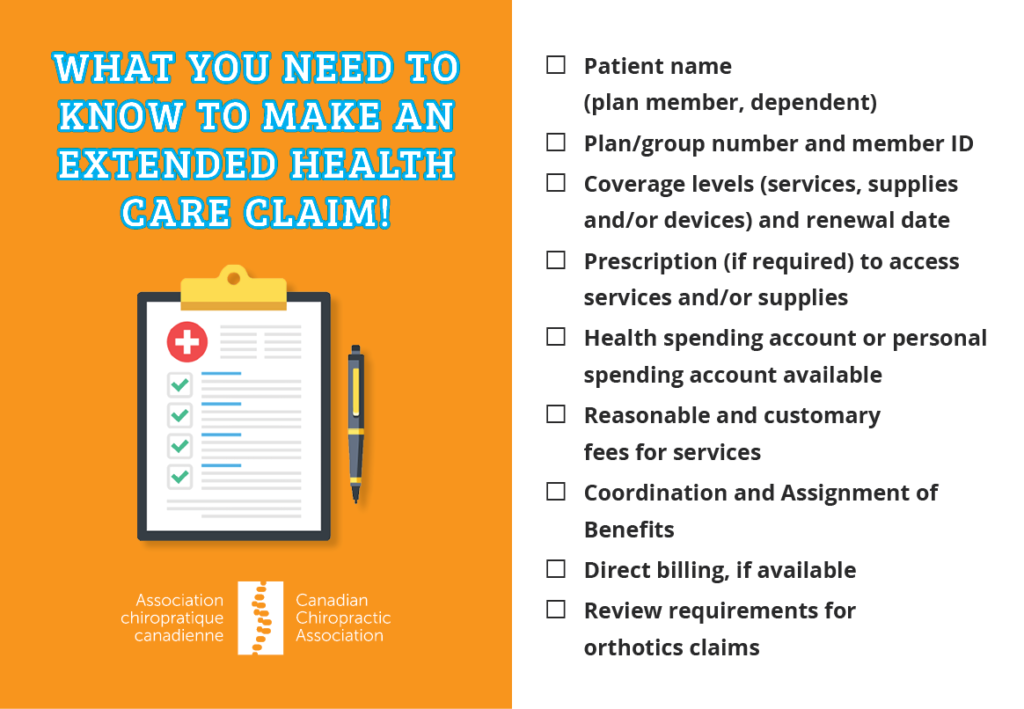

What you need to know to make an Extended Health Care claim!

- Patient name (plan member, dependent)

- Plan/group number and member ID

- Coverage levels (services, supplies and/or devices) and renewal date

- Prescription required to access services and/or supplies

- Health spending account or personal spending account available

- Understanding reasonable and customary fees for services

- Coordination and Assignment of Benefits

- If direct billing is available

- For orthotics, review ‘Documentation Required forOrthotic Claims’

Downloadable Checklist

Coordination of Benefits

Get a better understanding of what “Coordination of Benefits” are and what your patients are entitled to under their benefit plans.

Coordination of benefits is required when an individual is entitled to benefits under two separate benefit plans (for example, their own plan and their spouse’s). The guideline developed by the CLHIA describes the order in which benefits are determined and how to coordinate health payments.

The combined payment from all plans for a particular item cannot exceed 100% of the eligible medical expense. In some cases, the combined payment from all benefit plans on a particular service may be less than the submitted amount. To view the CLHIA Coordination of Benefits Guideline, visit www.clhia.ca and select the ‘Industry Information’ section.

Assignment of Benefits

Get a better understanding of what it means to have an “Assignment of Benefits”.

Assignment of benefits occurs when the plan member requests benefit reimbursement be made directly to the healthcare provider for the supplies or services delivered. Each insurance company, and even each plan sponsor, will have their own rules as to whether or not they will accept an assignment of benefits, and if so, for which benefits and for which type of healthcare professional.

Keep in mind that if the entire claim is not paid in full to the healthcare provider by the insured/benefit administrator, the remaining amount must be collected from the plan member. If the claim is paid in error to the healthcare provider, the healthcare provider will be asked to provide a refund.

It is important to note that assigning benefits does not remove any responsibility from the plan member. The plan member is still responsible to ensure that the submitted claim accurately reflects the services rendered, and it is the patient’s ultimate responsibility to ensure that the healthcare provider is paid in full.

Most plans have a time submission period, for example, 12 months from the date the service was received. Claims submitted after the 12-month period may be declined. This timeframe may vary and shorten if an employer chooses to move from one insurer/benefit administrator to another.

Accepting assignment does not increase the possibility that the healthcare provider will be audited by the insurer/benefit administrator. However, claims paid out for the services of regulated and non-regulated healthcare providers may be subject to audits by the insurer/benefit administrator. Assignment of benefits can be revoked at the discretion of the insurer/benefit administrator.

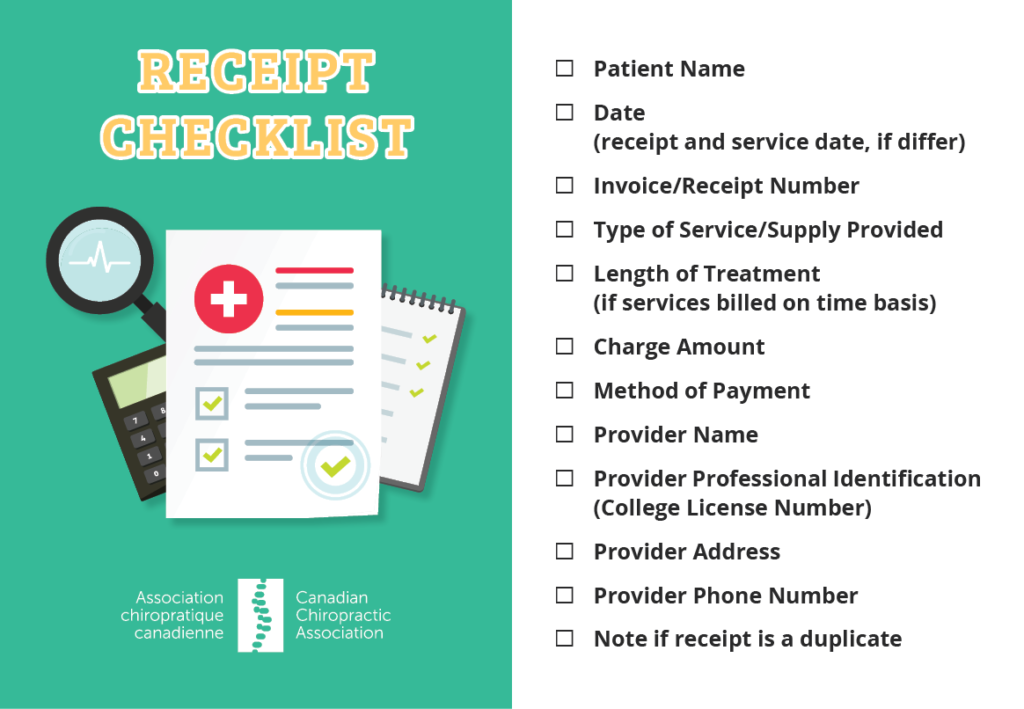

Issuing Receipts for Healthcare Services and Supplies

See below for best practices when issuing receipts including a downloadable checklist.

CLHIA has issued a public document entitled ‘Service and Supply Provider Receipts Best Practices for Group Benefit Reimbursement’, in order to assist healthcare providers and plan members to understand the information required to consider a claim for payment.

- Same best practices generally apply to both handwritten and computer-generated receipts

- Duplicate receipts should be identified as such

- Providers should not leave fields blank on receipt – either populate by N/A or a zero-dollar amount

- Provide receipt date and date of service (if rendered on date other than receipt date)

- A receipt should never be issued until the service or supply has been received and paid for by the patient and must always accurately reflect the details of the service or supply

- Provider name – full first and last name of individual who provided the service

- Provider address – business address of individual who provided the service

- Provider phone number

- Provider professional identification, designation or credential – clearly indicate DC and your license number

- Patient name – first and last name of individual who received the service

- Given that it is often the plan member who submits a receipt for reimbursement for themselves or their dependents, it is important that the receipt clearly indicates the service or supply provided, for how much and by whom

- Type of service/supply provided – identify whether it was an initial, subsequent or reassessment visit

- Otherwise, keep it simple! There is no need to itemize the list of techniques or modalities used, unless it is requested.

- Stay within the NMSK scope of practice.

- Length of treatment – if services are billed on an hourly or time basis

- Charge amount – actual cost of service to the individual

- Service providers should issue a receipt for the cost of the service or supply that they provided and for which they expect payment from the patient, regardless of whether or not a patient has access to any amount of reimbursement through insurance

- Receipt number

- Method of payment

Downloadable Checklist

Audits

Understand the routine process of audits and what’s required from you.

You’ve just received a notice that you’re being audited by a private insurance provider used by many of your patients.

Now what?

Don’t panic – insurance audits are relatively routine. Keep reading!

Audits are typically routine, rather than in response to a known or suspected problem and are intended to refine guidance on submitting claims. The objective of an audit is to establish that the services were provided to the patient and that the claim is eligible according to the terms of the contract.

A healthcare provider may be asked to provide details from patient records that confirm the need for treatment or supplies and the date on which treatment or supplies were provided to the patient. It should be noted that the healthcare provider will need the patient’s authorization to release information about his or her care or a guardian/parent in the case of a minor.

“Don’t treat the plan, treat the patient.”

– Greenshield Canada

Some examples of practices that might trigger an audit and/or demand for repayment include:

- Invoicing for an amount that includes a co-payment that the healthcare provider does not intend to collect from the patient.

- Invoicing for a service that wasn’t provided directly by the recognized healthcare provider without indicating that the service wasn’t provided by the recognized provider (e.g. when the service was provided by someone under the recognized provider’s employ or supervision); and

- Having a patient sign a claim form in advance of receiving a service or supply.

The Ontario Chiropractic Association (OCA) has developed a comprehensive resource, Understanding Audits: The chiropractor’s guide to administrative compliance. We thank the OCA for sharing this document with the CCA for dissemination to members across the country.

This downloadable tool is intended to help chiropractors proactively manage your practice and minimize the difficulty and inconvenience of an audit. While not a substitute for legal advice, it includes tips and information to guide you through an extended health care (EHC) audit process. Though the content is Ontario-centric, the suggestions in this resource can be nationally applicable in many circumstances. Download it here.

Orthotics

What you need to know to bill for Orthotics including a list of documentation required for Orthotics claims.

Custom made foot orthotics are functional devices made from a directly-molded impression of the patient’s full contours of the foot using plaster, slipper cast made of resin, foam impression, wax or 3D scan. The foot orthotic is constructed from raw materials and manufactured to each patient’s individual prescription. The foot orthotic is removable from the patient’s footwear. Generally, in order to be eligible for coverage under a group benefit plan the orthotics must be prescribed by the appropriate medical professional before the purchase is made.

It is important to note that most insurance companies and benefit plan administrators will only accept prescriptions for custom made orthotics from practitioners who are trained to diagnose and prescribe orthotics and who have medical training in problems related to the foot. These individuals generally include medical doctors, orthopaedic surgeons, chiropodists and podiatrists, but may also include chiropractors and physiotherapists. To ensure the plan participant is covered, they should be encouraged to seek clarification from their their employer or plan sponsor before incurring expenses. It is important to check if the practioner dispensing the orthotic can in fact also prescribe the orthotic. Many plans require the person dispensing the orthotic be different from the person prescribing. Make sure you check with the patient’s insurance company prior to making a claim.

For more information on Custom Made Footwear, Custom Made Foot Orthotics, Foot Orthotics Repair/Refurbishment or Off-the-shelf Insoles, please review ‘Understanding Claims for Footwear and Foot Orthotics’.

Documentation Required for Orthotic Claims

Insurers and benefit plan administrators typically require the following documentation when considering a claim for foot orthotics:

- A completed, signed and dated claim form

- A copy of the prescription written by an eligible prescriber indicating:

- – The patient’s diagnosis necessitating the use of foot orthotics

- A copy of the detailed biomechanical assessment, including foot exam and gait analysis

- An official paid receipt issued by the dispenser which shows:

- – Name and address of dispenser

- – Cost of orthotics including a breakdown of the cost of each modification performed

- – The date of full payment for the orthotic

- – The date the product was dispensed to the patient

- Copy of lab receipts indicating:

- – The address and phone number of the lab that made the footwear

- – The casting technique and raw materials used in construction of the custom made orthotic

- If modifications were made, the following must also be submitted:

- – If made off-site: a copy of the packing slip or lab document clearly indicating the manufacturer’s name, address and phone number, patient name, date of completion and details of product

- – If made by the dispenser, this should be clearly stated, and details provided

- An official paid receipt issued by the dispenser which shows:

- – The name and address of dispenser

- – A detailed description of type of orthotics provided

- – A breakdown of charges for the orthotics

416-585-7902

416-585-7902